Printable PDF version

Subscribe to our newsletter

Windows 8 is Coming!

PPP - Public-Private Partnerships

When Blah is Best

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

6517 Lakeview Drive

Falls Church, VA 22041

(703) 609-7494 (Washington, DC office)

4361 35th Street

San Diego, CA 92104

(619) 550-1187 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

www.TBDconsultants.com

Geoff’s IT Gems

Windows 8 is Coming!

Another version of Windows is coming soon, and this one is not only designed for PCs but also for tablets with their touch-screen capabilities. Here we take a sneak peak at Windows 8.

PPP – Public-Private Partnership

Private companies and public authorities have all been struggling a bit recently, so can they improve the situation by teaming up? In this article we look at Public-Private Partnerships, what they are and ways they can be structured.

When Blah is Best

Geoff Canham, Editor

Have you noticed that the markets are often reacting negatively to good news, because it wasn’t as good as people hoped, or positively to bad news, because it wasn’t as bad as they feared? There has been a lot of news, but not much has really changed. It has been said that the markets buy the rumor and sell the news, and there seems to be a lot of truth in that. We see some wild swings in the short time-span, but, as we see by looking at the long-term view of the Dow, as presented on CNN Money, we see the market has been slowly clawing its way out of the recession.

But slowly is definitely the name of the game, and it might be more comfortable if it was slow and steady, but steady it certainly has not been. On the construction front, the AIA’s Architecture Billings Index has also been moving slowly upwards, and recently has been in positive territory. The national average is around 52, 50 being the point of equilibrium, so being above 50 means that billings are increasing, but again it is slowly. With this writer being based in San Francisco, we have to note that the Western region is the only one that still shows below 50. On the positive construction front we have also seen increases in building permit applications and in housing starts, but that has to be tempered by the foreclosure situation which is ramping up again, rather than going away.

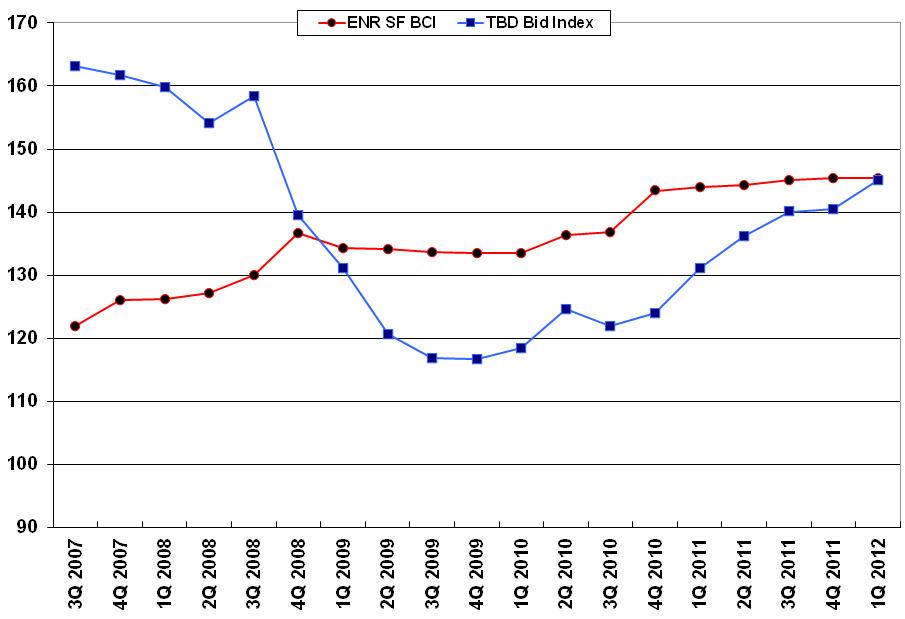

Our bid index is also continuing to slowly edge towards the nominal ‘norm’ represented by the path the ENR’s Building Cost Index, which shows how labor and material costs have been moving.

While the markets have been moving slowly upwards, there are a number of issues, mainly abroad, that have been causing short-lived dips in the market movements and have a potential for causing serious disruption to the economy.

Greece was an issue that we addressed almost two years ago in our 2010-Q3 edition, and which stubbornly refused to go away since then. It is beginning to look as though many in Europe would like Greece to go away from the Euro, and that remains a possibility. Whether or not Greece will default on its debts is no longer in question, it just remains to be seen how controlled that default will be. The deal with its private-sector investors is a promising start (where they ‘voluntarily’ take losses of up to 70%). But Greece really needs to continue opening up its restricted, uncompetitive markets to get its economy moving again.

Europe has its own problems, even disregarding Greece. A number of European nations, including Portugal, Belgium, Italy, the Netherlands, and of course Greece, are technically back in recession (meaning they have had at least two consecutive quarters of negative growth) and more could follow. The Eurozone economy as a whole shrank in the fourth quarter of 2011, but Germany and France stayed in positive territory, performing better than expected. In the UK, unemployment continues to rise and the governor of the Bank of England predicts that the country will ‘zigzag’ in and out of growth over the coming year.

In the Middle East, the situation with Iran has a potential for serious escalation, leading to disruptions in oil supplies, which might give a good boost to alternative energy resources, but otherwise would still be a serious disruption to economies worldwide. Brent crude oil rose to almost $120 per barrel in mid-February, as this article was being drafted.

On the home front we have the foreclosure situation referred to earlier. As the banks emerge from the robo-signing scandal, the number of foreclosures is going to rise again, stifling the recovery of the housing market.

Those issues, mentioned above, could make exciting news and be anything but blah, but they also probably are not where we want to be. So for now, if news is blah and the recovery is rather slow, but continuing upwards, that is probably the best we can expect. Slow, and as steady as we can get, will work for now, and let’s keep hoping the forward momentum starts increasing.

Design consultant: Katie Levine of Vallance, Inc.