Printable PDF version

Subscribe to our newsletter

LEED 5 is Coming

Office-Residential Conversions

Soft Landings

Construction

Management Specialists

Los Altos, CA

(650) 386-1728

San Francisco, CA

(415) 981-9430

Orinda, CA

(415) 981-9430

Sacramento, CA

(415) 872-0996

San Diego, CA

(858) 886-7373

Los Angeles, CA

(424) 343-2652

Seattle, WA

(206) 571-0128

Phoenix, AZ

(408) 868-6326

Portland, OR

(415) 359-5207

Dublin, Ireland

+353 86-600-1352 (Europe office)

www.TBDconsultants.com

The fifth version of the rating system from the US Green Building Council will come into effect next year, and so we are taking a quick look at the main changes.

Office-Residential Conversions

Empty office space and a desperate need for housing might sound like a neat combination of problem and solution. But here we look at some of the issues involved with turning offices into housing.

Construction work involves fairly substantial investments by the building owners, so they need to have a good feeling that the economy is going to be stable and support their revenue stream. However, the way the stock market has been bouncing around, it shows that some people are questioning the stability of the market. On the other hand, there are many voices that suggest that we are headed for a 'soft landing'. So, let's look at what a soft landing is, and what we need to look out for.

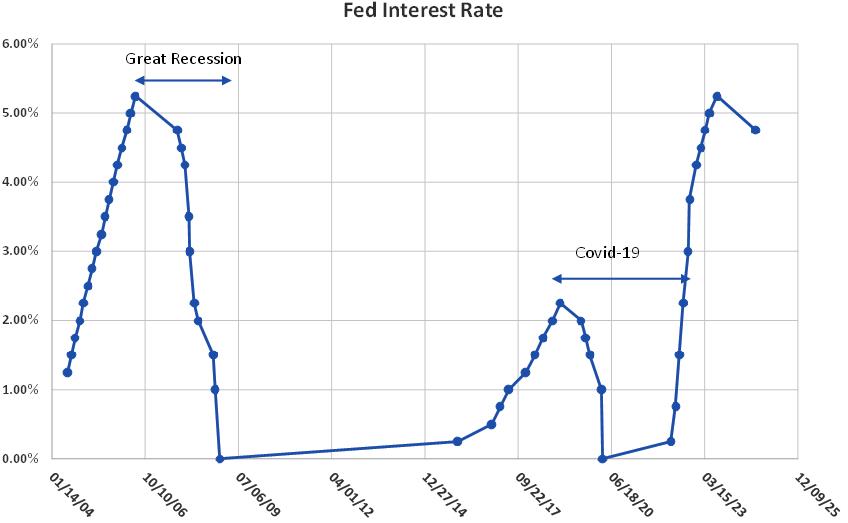

There is no official definition for what a soft landing implies, but it is usually taken to mean that the economy will recover from a period of high inflation without going into a recession. That doesn't mean that there won't be a slowdown in business activity, but it wouldn't be severe enough to count as a recession. A slowdown is exactly what the Fed's interest rate hikes were intended to achieve in order to tame inflation, but the economy remained stubbornly strong, even as inflation started to drop back towards the Fed's target. The Federal Reserve has now started lowering interest rates, but questions about the market still remain.

The consumers' purchases form a substantial portion of the US GDP, and consumer activity has been holding up very well. However, there are concerns that the level of consumer debt is rising, with credit card defaults increasing and indications that consumers are switching their purchases to lower cost items. On the other hand, while unemployment levels have been inching up, they are still at historically low levels, and wages have been increasing to match inflation.

Recently, the stock market has been driven substantially by hype about AI, and it seems that a more realistic evaluation of AI's potential has largely been a cause of the slump in the Nasdaq, with spillovers into the rest of the market, but business activity has remained strong. With the stock market mainly being driven by either greed or fear, it is not really a good barometer for how business is really performing.

It is said that we need to watch three main items to gauge how we are doing as we approach a landing. The first is the labor market which is currently giving mixed signals. The August jobs reports showed a pickup in the labor market following a poor showing the previous month, although August's gain wasn't as high as anticipated. The second point to watch is the consumer spending, and that has been holding up better than many commentators expected, but it is showing signs of coming under pressure. The third point is what the Fed is doing, and they have now started lowering interest rates and they still have plenty of room for moving them rapidly downwards if the economy shows too much sign of weakness.

As your flight is arriving at its destination, the cabin crew will instruct you to fasten your seatbelts, even though smooth landings are very much the norm these days with the airlines. The controls that the Fed have available to them have been optimistically referred to as 'blunt instruments' in comparison with an aircraft's controls, so as the economy heads for a landing you might want to buckle up tight.

Geoff Canham, Editor, TBD San Francisco

Design consultant: Katie Levine of Vallance, Inc.