In this Edition

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

6518 Lonetree Blvd., Suite 164

Rocklin, CA 95765

(916) 742-1770 (Sacramento office)

600 B Street

San Diego, CA 92101

(619) 814-6793 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

2063 Grant Road

Los Altos, CA 94024

(650) 386-1728 (South Bay office)

7083 Hollywood Blvd., 4th Floor

Los Angeles, CA 90028

(424) 343-2652 (Los Angeles, CA office)

1a Zoe House, Church Road, Greystones

Wicklow, A63 WK40, Ireland

+353 86-600-1352 (Europe office)

www.TBDconsultants.com

The Internet of Things has given hackers a lot more targets. California's Senate Bill 327 is first piece of legislation in the U.S. to specifically address this issue, helping to keep our buildings secure.

Solar power seems like an ideal way to help the environment and save long-term costs. Here we look at the economics and other issues surrounding a proposed solar installation.

This article is being written at the start of September as the UK’s new Prime Minister, Boris Johnson, has parliament rebelling against his plans, or lack of them, for withdrawing from the European Union. There seems to be total confusion about what is going on, but there is fear that a no-deal Brexit will throw the UK into recession. Germany is already on the verge of a recession as their export-driven economy suffers under the slowdown in international trade, and there are concerns that a messy Brexit would only compound matters. Italy is also suffering economically.

In Asia, China’s growth has dropped to around the same as it did during the depth of the Great Recession. Other Asian countries that are verging on, or already in, recession include Hong Kong, Singapore, and South Korea. Japan appears to be doing well at present, but, like Germany it is dependent on international trade, and that is in flux with the on-and-off trade wars.

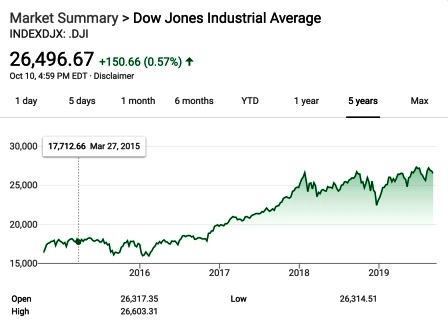

In the US, the bond market inversions (when it becomes cheaper for the government to borrow for ten years, rather than two) has been getting people talking of recession. The AIA’s Architectural Billings Index (ABI) has predicted the last two recessions by dropping below the 50 mark (the breakeven point, meaning billings are neither increasing nor decreasing), and it has been bouncing around that mark for months, after starting out the year strong. The stock market went on a steady rise until the start of 2018 as it recovered from the Great Recession. Since the start of 2018, it has been basically going nowhere, in steep jumps up and down, but doesn’t seem to have any real sense of direction. And the US manufacturing sector is said by some to have already fallen into recession.

That said, there does not appear to be any real reason for thinking that recession is coming to the US in the near future. There is always the possibility that the trade war or some international hotspot, like Iran, might upset markets enough to trigger a recession, but that is something that can’t be predicted ahead of time. When a bond market inversion has preceded a recession, the inversion has lasted for months, not just days. When the ABI has foreshadowed a recession, it has done it by remaining consistently below 50, not just bounced around that mark. The stock market may have been taking some big hits recently, and then recovering on news of talks about talks, but it has still been hitting new highs along the way as the economy keeps growing at around 2%.

The most important sign is that consumer confidence has remained high. The fact that the last round of tariffs on Chinese goods will affect prices on consumer goods is of some concern, but while unemployment remains at historic lows and wages are rising, confidence shouldn’t be adversely affected much. With consumer sales making up almost 70% of the U.S. GDP, you can see how important that is.

With so many signs at home and abroad that might indicate an upcoming recession or a continuation of the bull market, it is easy to understand the confusion that many people are in. With the confusion surrounding the markets being mirrored so extensively by the antics in the U.K. parliament, whatever happens with the markets here, let’s just blame Brexit.

Geoff Canham, Editor, TBD San Francisco

Design consultant: Katie Levine of Vallance, Inc.