In this Edition

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

1663 Eureka Road

Roseville, CA 95661

(916) 742-1770 (Sacramento office)

9449 Balboa Avenue, Suite 270

San Diego, CA 92123

(619) 518-5648 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

2063 Grant Road

Los Altos, CA 94024

(650) 386-1728 (South Bay office)

9705 Cymbal Drive

Vienna, VA 22182

(703) 268-0852 (Washington, DC office)

www.TBDconsultants.com

BIM has lost its 'new boy on the block' label, and is becoming mainstream, so there must be benefits to it. But are there also drawbacks? Here we look at both sides of the coin.

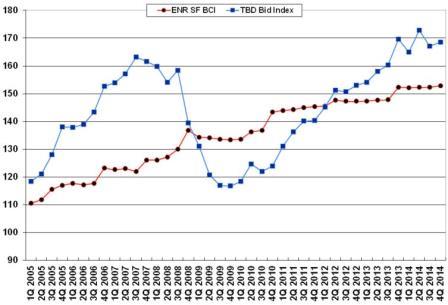

A decade ago, back in 2005, all sections of the construction industry were booming, and while growth slowed a bit during 2006 and 2007, things were still looking rosy. The sub-prime losses that emerged in 2007 might have been troubling, but if you weren’t directly involved, they didn’t seem worth worrying about. Things may not have been looking as good in 2008, but it wasn’t really until the collapse of Lehman Brothers in September 2008 that everyone sat up and paid attention. Then 2009 saw the bottom fall out of the the construction market. The US National Bureau of Economic Research declared that the recession had begun in December 2007 and ended in June 2009, but different industries were affected at different times, and the recovery has been so slow that even now some still have difficulty believing it is really over.

But the reality is that here in the US confidence is back, and employment is picking up steadily, with the result that more money is flowing in the market. The construction industry has been benefitting, as indicated by the positive trends showing up in the Architectural Billings Index. The potential dark clouds hovering on the horizon are almost exclusively from abroad, such as the turmoil in Ukraine and the Syria/Iraq region, and the disappointing economic situation remaining in Europe. But happily Europe just managed to avoid dropping back into recession.

The current labor and material escalation in the US construction market is around 3% to 4% based on projected labor rate increases and known material increases. This is anticipated to hold for the near future.

During the recession and its aftermath (2008 through 2011/2012) the construction industry lost a lot of its labor force to other professions. As the construction industry is picking up, skilled labor that was previously in the construction industry is not returning. As a result, the skilled labor shortage is anticipated to be a main driver for subcontractor profit margins over the next 5 years or so.

Some recent materials spikes have been in glass, lumber, and structural steel. Overall average increases in material prices have been in the 3% to 4% range (as with labor), but spikes in individual material prices are inevitable. China continues to consume large amounts of construction materials and affect the supply of materials, but that nation has been experiencing a slowdown recently, which should ease pressure on the material supply.

Profit margins have increased over the past 3 years at a steady rate. As skilled labor shortages become more prevalent, profit margins are going to increase more subsubstantially, and in some markets they are already doing so. Currently there is sufficient ‘high profit’ work available, with the result that less attractive work (such as complicated renovations) is likely to have problems getting bidders, and those that do bid the work can be expected to increase their profit margin above normal.

The largest risk item in the current market is this shortage of skilled labor. While this is already affecting the market to a noticeable degree, the level of construction work is not back to pre-recession levels yet, so the effect is not consistent across markets. However, any project that is seen as problematic in any way can be expected to attract high bids.

Geoff Canham & Michael Teggin, TBD Consultants

OK, ZEB stands for Zero Energy Building, but that does not resolve the issue. In this short article we look at some of the different interpretations of the term, and what the bottom line is.

Design consultant: Katie Levine of Vallance, Inc.