In this Edition

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

1663 Eureka Road

Roseville, CA 95661

(916) 742-1770 (Sacramento office)

9705 Cymbal Drive

Vienna, VA 22182

(703) 268-0852 (Washington, DC office)

4361 35th Street

San Diego, CA 92104

(619) 550-1187 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

www.TBDconsultants.com

3D printers are the latest 'in' gadget, but you might see something similar coming to a construction site near you soon. Here we look at the use of 3D printing technology for constructing buildings.

Change is the big constant in life, and in this article we look at techniques for managing the changes that someone in the construction industry might come up against.

Towards the end of January, Ben Bernankeís term of office expires and, at the time of writing (mid-Nov), his successor is confidently expected to be Janet Yellen. She will bear the responsibility for guiding the nation through the transition from a market supported fairly extensively by the Federal Reserve, back to a real free-market economy. Although perhaps we can hope that the financial institutions are not quite as free to play fast and loose with our money as they were before the Great Recession.

The end of the Fedís bond buying program, or Ďtaperingí as itís known, can be expected to start happening early in the new year, assuming it didnít start in December. But that is one change that we can definitely expect to see being spread over an extended period of time. It has certainly been talked about for long enough, and when it really does happen we can expect the usual adverse reaction by the stock market, but overall it should be good for the economy.

That program has been credited with keeping interest rates low, and even talk of tapering has caused interest rates to start edging up, so rising interest rates is another change we can expect to see soon. But the slow tapering off of the bond-buying program should mean that we donít see too dramatic a shift.

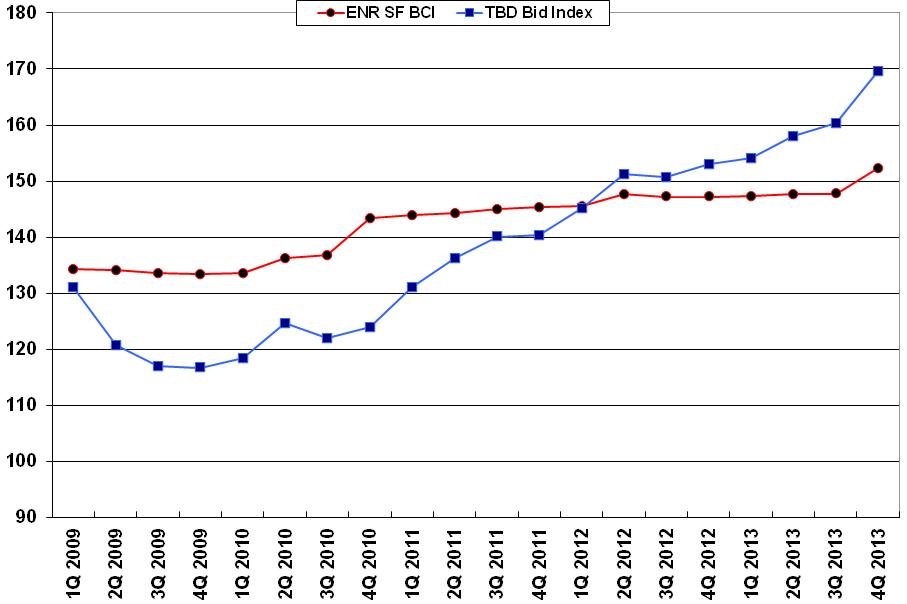

The bond-buying program has been pumping a considerable amount of money into the economy, estimated at around $3 trillion, with a current (Nov 2013) rate of about $85 billion per month. But a large proportion of that money has simply ended up in bank vaults. If and when the banks actually start lending out that money, it will increase the cash flowing in the market, which could start to drive up inflation. To date, the Fed has not had to worry about inflation because the effects of the recession and fairly high unemployment have depressed the market, and avoiding deflation has been a larger concern. But that is another change we can expect to see starting this year. We have certainly already started to see construction costs rising more, but that can still largely be considered recovering from lows.

The loss of labor requirement in these kinds of industries has led to the unemployment and underemployment, and while people are not fully employed they are less likely (or able) to spend freely, and so we find ourselves in a bit of a vicious circle. Low spending levels equal less need for production equals less need for employment equals low spending levels.

The Federal Reserveís program has been aimed mainly at building up the economy so that unemployment rates will drop. The October job growth figures showed promising results in that field, despite the government shutdown, so hopefully we are finally seeing momentum there.

With an improvement in the employment situation we should see a pickup in consumer confidence and an increase in consumer spending. With the US gross domestic product relying so much on consumer spending, that will definitely be good news for the economy.

The new year will also see a rerun of the debt-ceiling/borrowing-limits debates, and we can hope that we might see some change in political rhetoric when that happens, but that is one situation where this writer suspects major change is unlikely to happen. But we live in hope.

So, it is likely to be an interesting year ahead for us all, and if Ben Bernanke had a tough enough job seeing us through the recession, Janet Yellen could be facing an equally challenging time bringing us out of it.

Geoff Canham, Editor

Design consultant: Katie Levine of Vallance, Inc.