In this Edition

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

9705 Cymbal Drive

Vienna, VA 22182

(703) 268-0852 (Washington, DC office)

4361 35th Street

San Diego, CA 92104

(619) 550-1187 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

www.TBDconsultants.com

In a few short decades the Internet has moved from a way for the military and some academics to share information, to an indispensible tool for business and recreation. But where does this so-called cloud actually reside? In this article we look at the data centers which our online activity depend on.

Data doesn't only reside in data centers, it also fills our ever-growing hard drives and other storage media. In this article we look at some of the tools for managing your own data.

We have been discussing data centers and managing data, but what is the data saying about the economy, and what does it portend for the construction industry?

Here in the US, the stock markets are hitting record highs, and are up about 15% since the start of year. Despite that rise, the average Price/Earnings ratio is still below what had been considered the norm before the recession hit, so the bull market might not be peaking yet. And company earnings are doing well, with about 65% of them beating the estimates in the first quarter. The unemployment situation continues to improve, but slower than we would like. The economy lost almost 9 million jobs in the financial crisis, and has recovered over 6 million, but it is estimated that around 8 million are underemployed (working part time when they would prefer full time). The housing situation is also improving, while the foreclosure crisis is winding down. House prices rose 10.2% during the first quarter, and building permits rose, exceeding the one million level for the first time in about 5 years. With the improvements in unemployment and housing, consumer confidence has been improving, hitting a 5-year high in May, and inflation remains weak. The Federal Reserve has kept its short-term interest rate near zero since Dec 2008, which has been a driver in the housing recovery, making mortgage rates affordable for many. The Fed has set unemployment levels at 6.5% or inflation at 2.5% as trigger points for adjusting interest rates, and that is not expected before 2015. Quantative easing (QE2), where the Fed buys $85 billion a month of Treasuries and mortgage-backed securities has been a driver behind the rise in stock market prices. Some Fed officials have been calling for an end to the monetary stimulus this year, and that news has caused some big drops in the stock market.

In Europe the situation isn’t as good. The OECD (which represents 34 advanced economies) said the eurozone will shrink by 0.6% this year, and speculated that prolonged economic weakness in Europe could damage the global economy. Eurozone unemployment currently averages 12%, but is forecast to stabilize in 2014. The blame for this level of joblessness is normally laid on austerity measures, weak confidence and tight credit conditions. The economy of the eurozone has contracted for the past six quarters, and nine of its members are currently in recession. It is now three years since Greece got its first bailout, but the enforced austerity has sent unemployment to 27%, and over 60% of young workers have no job. But the country’s economy is forecast to start growing again in 2014. France is back in recession for the second time in four years, and French consumer confidence in May was at its lowest level since July 2008. Germany avoided dropping into recession, and has shown increases in industrial output, but at time of writing (early June) was suffering from bad flood conditions.

China has been the most prominent growth center in the world recently, but currently it has dropped to only 8% growth. Of course, that is still way above what the US and Europe has managed since the Great Recession, but while that growth has dropped, China’s use of credit has been growing, and the quality of its investments has been questioned. However, China’s industrial production was up in April, and there have been increases in China’s exports.

Japan had been stagnating and suffering from deflation, but following the ‘Abenomics’ economic reforms, stocks have soared. The Bank of Japan has been pumping money into the economy and the Yen is down 15% against the dollar this year, and Japan’s economy is expected to grow by 1.6% this year. But there have been some big drops in the market recently.

So, worldwide nothing appears to be desperately wrong with the economic situation, unless you are (say) one of the unemployed in Greece. And while generally things are improving, they are improving way too slowly for most. For instance, here in the US employment has been improving, but the number of jobs created still hasn’t caught up with the number of people joining the potential workforce. And there are still too many open questions about how the financial problems will be addressed by the politicians, and the markets hate having doubt. Although the stock market doesn’t like it, the fact that the Fed is starting to talk about being able to take the nation off life-support should be seen as a good sign.

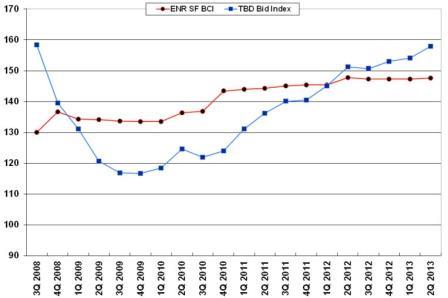

At least construction has started to show growth again, but now we have the problem that so many people have left the industry that construction workers are becoming difficult to find. Material production has also been reduced, and while it ramps up again we can expect to see many fluctuations up and down in prices – but generally up, of course.

Design consultant: Katie Levine of Vallance, Inc.