In this Edition

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

1415 S.Barton St.

Arlington, VA 22204

(703) 609-7494 (Washington, DC office)

4361 35th Street

San Diego, CA 92104

(619) 550-1187 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

www.TBDconsultants.com

QE2 in a Storm

Geoff Canham, Editor

When Ben Bernanke announced that the Fed was planning a new round of purchasing Federal bonds, the markets seemed to be looking forward to it. The process, known as quantitative easing, became known as QE2 as it was a follow-up to the initial $1.75 trillion round earlier in the Great Recession, and the idea is to pump more money into the economy with the goal of getting the economy moving faster. When QE2 was actually implemented, the stock markets (both in the US and around the world) behaved as expected, showing an increase, but complaints (and mildly disguised abuse) started coming from around the world, and even within the US.

The main complaint from abroad was that QE2 would also lower the value of the dollar, making US exports cheaper and making foreign products less competitive in the US markets. The fact that one of the most vocal complainers was China was felt to be rather ironic, since there have been long complaints about them keeping their currency artificially low. Complaints from Europe were fairly easy to brush off because they were not proving to be the greatest money-managers, seeing the problems the Euro was having. Ireland was the latest European country to make the headlines at that time, as they were being forced to accept a bail-out after a housing-bust to beat all housing-busts and their banks had got into such a mess they had to be virtually nationalized. And then came Portugal.

But at least the bickering going on at the recent G-20 meeting in Seoul is probably a sign that things are getting back to normal. If they start cooperating again we will know we are in really serious trouble ;-)

The homegrown complaints about QE2 were mainly related to the possible effects on inflation. Pumping more money into an economy does have inflationary effects, and getting it up to around 2% is actually another goal of the Fed. A bit of inflation helps to get people buying, because it makes todayís rate look like a sale price. But too much inflation, especially when unemployment is still high, can be very troubling, leading to a situation called stagflation.

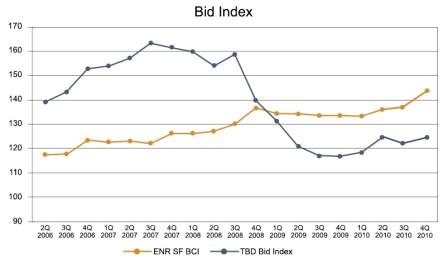

The ENR BCI, reflecting construction labor and material prices, has been showing some increase, whereas our bid index remains basically flat.

We are seeing some improvements in the employment situation. This writer was recently on a research trip to Indianapolis and Nashville regarding some residential investment properties there, and in both places we were told the employment situation was showing an upward trend. And in the Oakland Tribune for November 20 (when this article was being written) it stated that the figures for October showed the second straight month of job gains for the nine-county Bay Area, even if the gains were "tepid".

But we are still seeing indicators that the recovery is going to be drawn out. For instance, the foreclosure situation is still ongoing, with nearly a million homes expected to be repossessed this year. We have seen charts comparing this recovery with the one in the early Ď80ís (in Stephanie Flandersí blog for Oct 26 on bbc.com), which was also drawn out but didnít have as big a hole to drag itself out of. In our 2009 Q4 edition of our newsletter we compared the tracks of the current recession with that of the Ď90s. The comparative date for this recession, to when we were saying construction activity was getting busy again, would be June 2013. That still looks like a reasonable date. The Fed, at their meeting in Nov 2010, were suggesting the recovery might take twice as long as that, but the ups and down in the economy very seldom happen at a predictably steady pace, and once we get some real upward momentum we could see a rapid turnaround.The economy grew at an annualized rate of 2% in the third quarter this year (it was at 1.7% in the second quarter), so we are moving in the right direction, even if it is slowly.

The UK is also having a slow recovery, but over there one of the driving forces in the recovery is construction (reported to be 11% higher than the year previous). Now that is something they could export to us!

Hope you have a great New Year.

IPD Part 2

Gordon Beveridge

IPD has been talked about a lot recently, as we did in our previous newsletter. This time we complete our look at whether IPD is really something new, or a variation on something that has been around for a long time.

Do we need another rating system for Green construction? Another one is being launched, and this time it is for civil construction projects.

Design consultant: Katie Levine of Vallance, Inc.